In previous articles, I have shown how three factors may help cut the risk in a portfolio: Return on Assets, Piotroski F-score, and Altman Z-score. competitors in 2022 to date (Portfolio123) VFQY has been slightly lagging them in 5.5 years. direct competitors: the BTC iShares MSCI USA Quality Factor ETF ( QUAL) and the Invesco S&P 500 Quality ETF ( SPHQ). The next chart plots VFQY performance since inception vs. However, price history is short and may not represent long-term relative performance. Since inception in 2018, VFQY has underperformed the S&P 500 by a significant margin in annualized return and risk-adjusted return (Sharpe ratio). Source: Fidelity VFQY ETF Past performance

Valuation metrics are much cheaper than for the S&P 500, as reported in the next table. Sector weights (chart: author data: Vanguard) It underweights technology, consumer staples, communication, real estate, and utilities. Compared to the S&P 500 ( SPY), VFQY overweights consumer discretionary, industrials, healthcare, financials, and materials.

Other sectors are below 5% individually and 16% in aggregate. The fund is balanced in the top 5 sectors: technology, consumer discretionary, industrials, healthcare and financials weigh between 15.1% and 19.5% of asset value. The largest holding is below 1.5%, so risks related to individual stocks are very low. The portfolio is diversified: the top 10 companies, listed below with some basic ratios, have an aggregate weight of 12% of asset value. companies of all size, from micro to mega caps. Securities with relatively strong fundamentals may be identified by measures such as strong profitability, sustainable earnings, and healthy balance sheets.” VFQY has a portfolio of 590 stocks, a dividend yield of 1.23% and an expense ratio of 0.13%.Īs described by Vanguard, the management team selects stocks using “ a rules-based screen designed to promote diversification and to mitigate exposure to certain less liquid stocks. Quality Factor ETF ( BATS: BATS: VFQY) was launched on with the objective of investing in stocks with strong fundamentals. Holdings and data change over time, so updated reviews are posted when necessary.

#Drawdown bar series

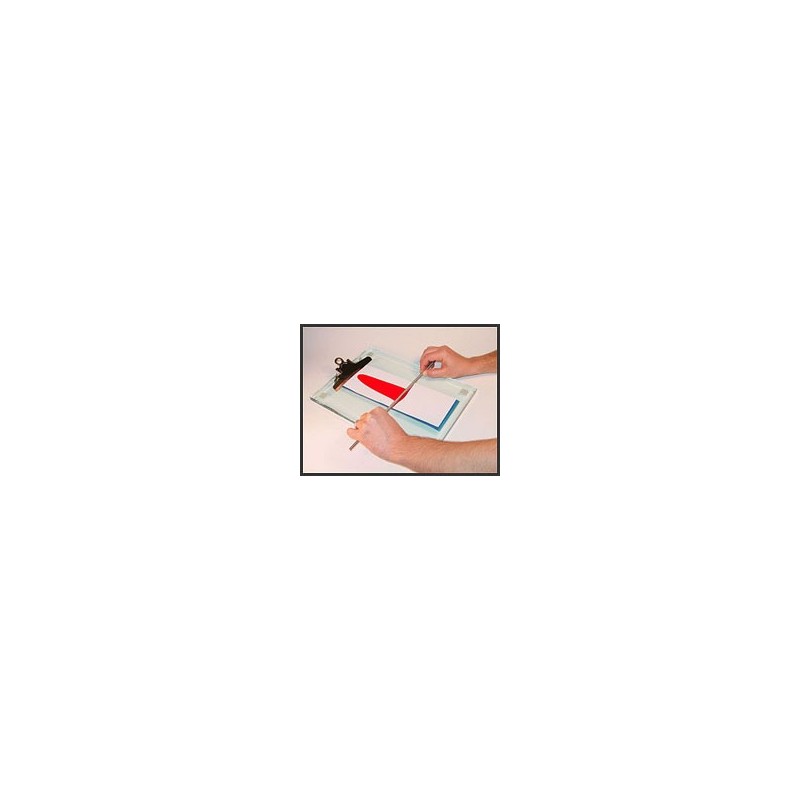

Package Dimensions: 8.5 x 2.6 x 2.This exchange-traded fund ("ETF") article series aims at evaluating products regarding the relative past performance of their strategies and quality metrics of their current portfolios. Set Contains: Drawdown Bar Film Applicator^Theoretical Wet Film Thickness (20.0 mils)^Gap Clearance (40.0 mils)^Film Width Inches (6 cm) The actual wet film thickness can vary from 50% to 90% of the gap depending on the gap clearance. The drawdown process consists of many variables. We cannot guarantee that you will draw-down the theoretical wet film thickness. If you have a gap clearance of 6 mils, the theoretical wet film thickness etched on the bar applicator is 3 mils. The theoretical wet film thickness is etched onto every drawdown bar and is roughly one-half the actual gap clearance.

0 kommentar(er)

0 kommentar(er)